Reddit:

Money for Nothing, Clicks for Free.

- Reddit is a $19B social media forum led by founder Steve Huffman. The stock IPO’d in March 2024 to tremendous hype, surging 251% by the end of the year.

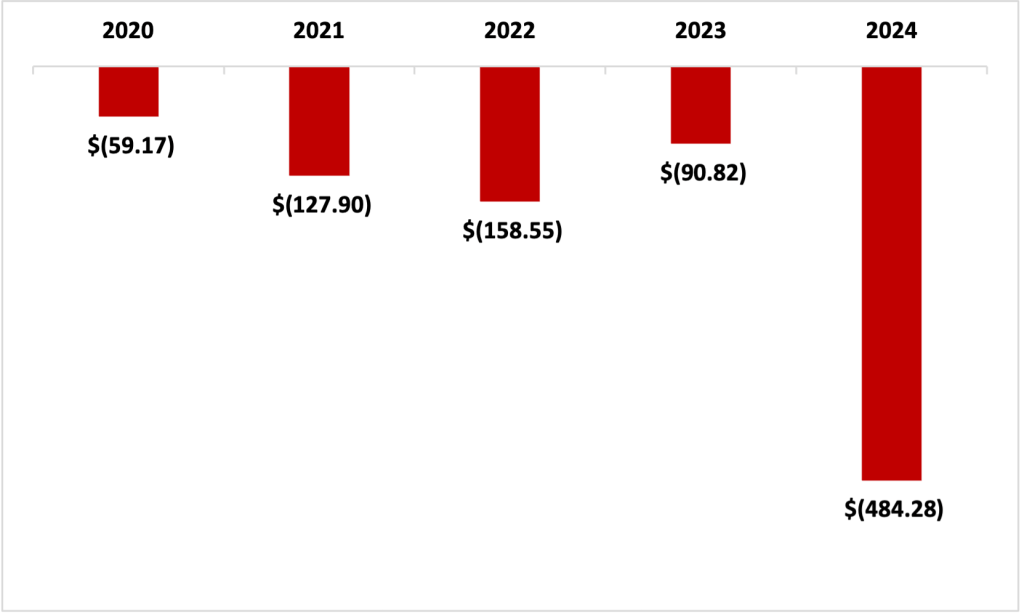

- After halving from Feb. 2025 highs, the stock is still up 136% from IPO despite being unprofitable for every recorded period since 2020.

- Despite their incredible stock momentum, they managed to multiply their annual losses five times in 2024, burning $484M compared to 2023’s comparable ~$90M loss.

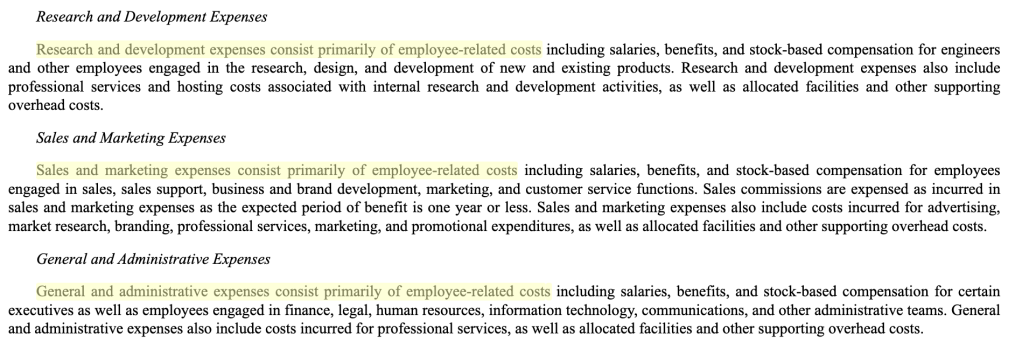

- Reddit creates the illusion of productivity by dismissing ballooning expenses as “Research & Development” and “Sales & Marketing,” confessing that all of their expense categories are “primarily employee related costs” (compensation) on the obscured 60th page of their 10-K.

- During this exceptional period of stock performance, the company admits to offering “elevated stock-based compensation,” likely to enrich employees and executives.

- As such, the stock is overvalued by quite literally all metrics.

- Since Reddit isn’t profitable, its stock price is dependent on optimistic user growth figures, which are already diminishing into 2025.

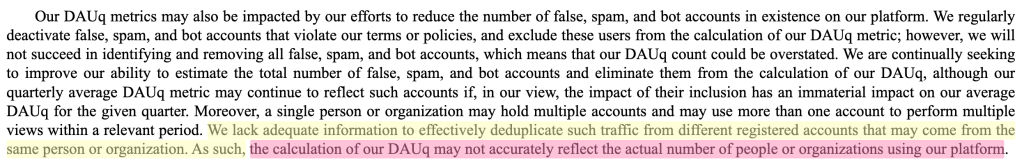

- Reddit admits that their DAUq (Daily Active Unique Users) numbers are hard to track, with further due diligence suggesting they are hyper inflated.

- The company likely abuses Google search engine results to count one user as five “DAUq,” obviously inflating the statistic by upwards of 500%.

- The company has a terminally flawed monetization strategy wholly based on advertising revenue, yet they lack the scale of a more stable company like Meta (Facebook/Insta) and Google (YouTube/Google Ads) propped up by significantly more diverse revenues.

- The platform itself is fatally inferior as it offers no exposure to the recent explosion of short-form content, lagging behind competition.

- Reddit’s ad interface is equally inferior, with a poor value pipeline.

- Bots—some of which are theorized to be controlled by Reddit itself—run rampant on the platform, with users estimating that 70% of Reddit accounts are bots.

- The platform has an at best poor and at worst intentionally harmful moderation system, with misogyny and other less favourable “topics” hosted freely on the platform.

- Reddit at large bears a reputation for being the unmoderated wasteland of the internet.

- Reddit knowingly shut down countless popular “subreddits” (pages) to clean up its reputation in advance of its IPO. While an effective PR move, it also evaporates their already thinning moat.

- CEO Huffman has no real management experience despite heading a billion-dollar public company. This is supported by his streak of immature and unprofessional behaviour.

Background: Steve Huffman’s Starboy

Founded by CEO Steven Huffman in 2005—alongside a group of fellow University of Virginia students like Aaron Swartz, who would later famously be sentenced to 35 years in prison for wire fraud at MIT—Reddit is a $19B social media platform most comparable to a forum and social news aggregator.

Per its FY2024 filings, the platform hosts 101.7 million DAUq (Daily Active Unique Users) internationally. Reddit is famously host to thousands of communities (forums) called subreddits, each based on specific topics and conversations. Take, for example, r/explainlikeimfive, where users help each other learn complex topics via elementary explanations. The site and app is also home to iconic forums r/WallStreetBets, a touchstone for today’s retail investors where they share their gambles on 0DTE SPY calls.

Reddit describes itself as a “self-sustaining ecosystem,” where both content creation and moderation are handled entirely by users.

The site has seen explosive user growth even two decades after its founding, with global DAUq increasing a whopping 39% YoY in 2024, compared to 27% the year prior.

Reddit takes on the standard SAAS/social media business model, with advertising making up 92% of their annual revenues.”Reddit Premium” subscriptions offer users marginal benefits on the platform, and as such only make up an insignificant fraction of their income.

The U.S. is Reddit’s most monetizable and lucrative market, being 81.8% of their annual revenues. America also made up 46% (48M) of their Dec. 2024 user base.

Just before its twenty-year anniversary, Reddit IPO’d at a price of $46/share before reaching a $225 high amidst February earnings. The stock has since halved, and now hovers around $100-$125.

Bull Case: Explosive User Growth on the Path to Profitability

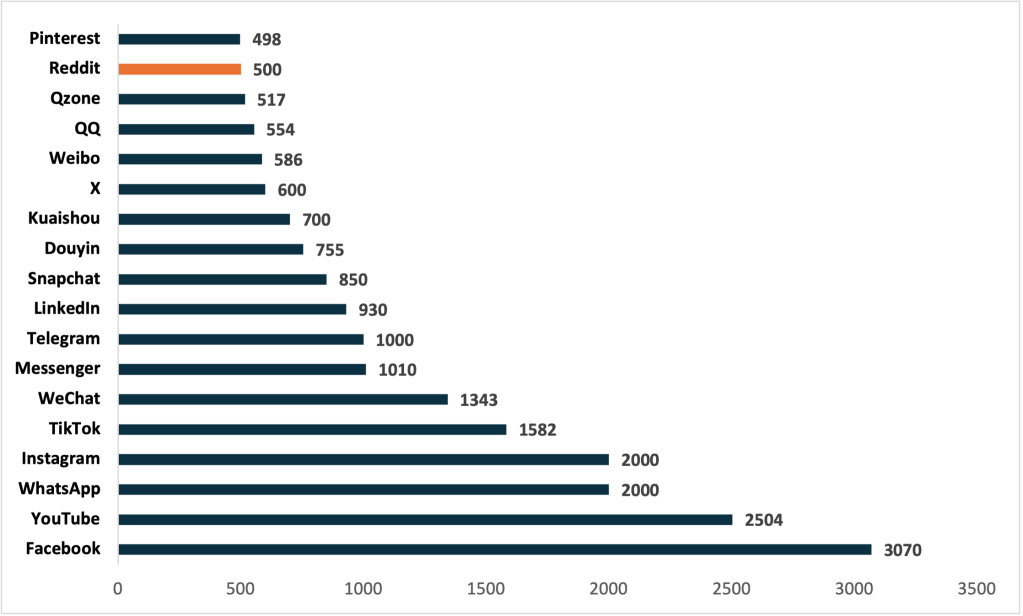

Reddit, despite being unprofitable, has indisputably seen titanic user growth in the last few years. Forbes and Statista rank Reddit as the world’s 16th most popular social media platform, just behind China’s QZone and edging ahead of Pinterest.

The platform has carved its own respectable niche of more “intellectual” content like world events and is very well a staple of the internet landscape. It has, for the last twenty years, also been reasonably successful as a social media titan. Advertisers are rightfully drawn to the platform by its distinct ability to offer exposure to precise audiences—a stock brokerage, for example, will likely want to target investing related communities on Reddit rather than “spray-and-praying” on YouTube, TikTok and Instagram.

Management has also provided optimistic guidance on advertising volume growth, highlighting Reddit’s focus on small and medium sized businesses—the same model that made Facebook Ads so lucrative in the early 2010s.

Analysts are also roaring over the stock, referring to Reddit as a well of untapped potential at the cusp of profitability. Many argue that optimizing the platform’s advertising pipeline and refining its less-favourable image would be a landmark turning point for the company.

Taming the Bulls: Poor Monetization

Despite analyst expectations, it is explicitly clear that Reddit is a chronically flawed platform; this is a truth I believe most of Wall Street is critically blind to simply because they don’t actually use the product.

Reddit does not have the pure impression volume advantage of a site like YouTube, nor the longstanding credibility of an iconic service like Google Ads. Further, their “Reddit Premium” system (around 10% of annual revenues) has nowhere near the durability of the standard SAAS business model behind a powerhouse like Pinterest.

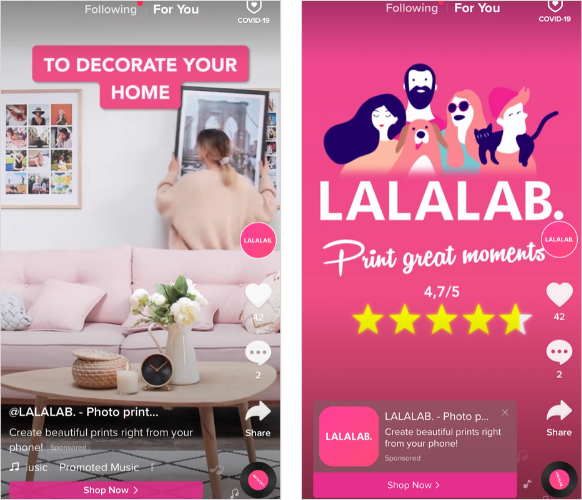

Advertising itself is Reddit’s most overlooked flaw. Unlike YouTube, TikTok and Instagram, the “quality” of ad impressions on Reddit is astonishingly poor:

Similarly poor placements are found obscured between user-generated comments on the site’s post. Advertising on Reddit is no better than buying a billboard in a Kansas grain field. We can compare Reddit’s ad placement to something like TikTok’s in-feed ad’s (credit One9Seven6):

yWith one ad placement approximately every thirty posts and an occasional placement obscured between comments, Reddit proudly prioritizes user experience over profitability. This model worked great when the company was nothing more than a cool website, but becomes problematic when the “cool website” suddenly needs to create shareholder value as a publicly-traded company.

It’s almost as if Reddit just doesn’t want to make money.

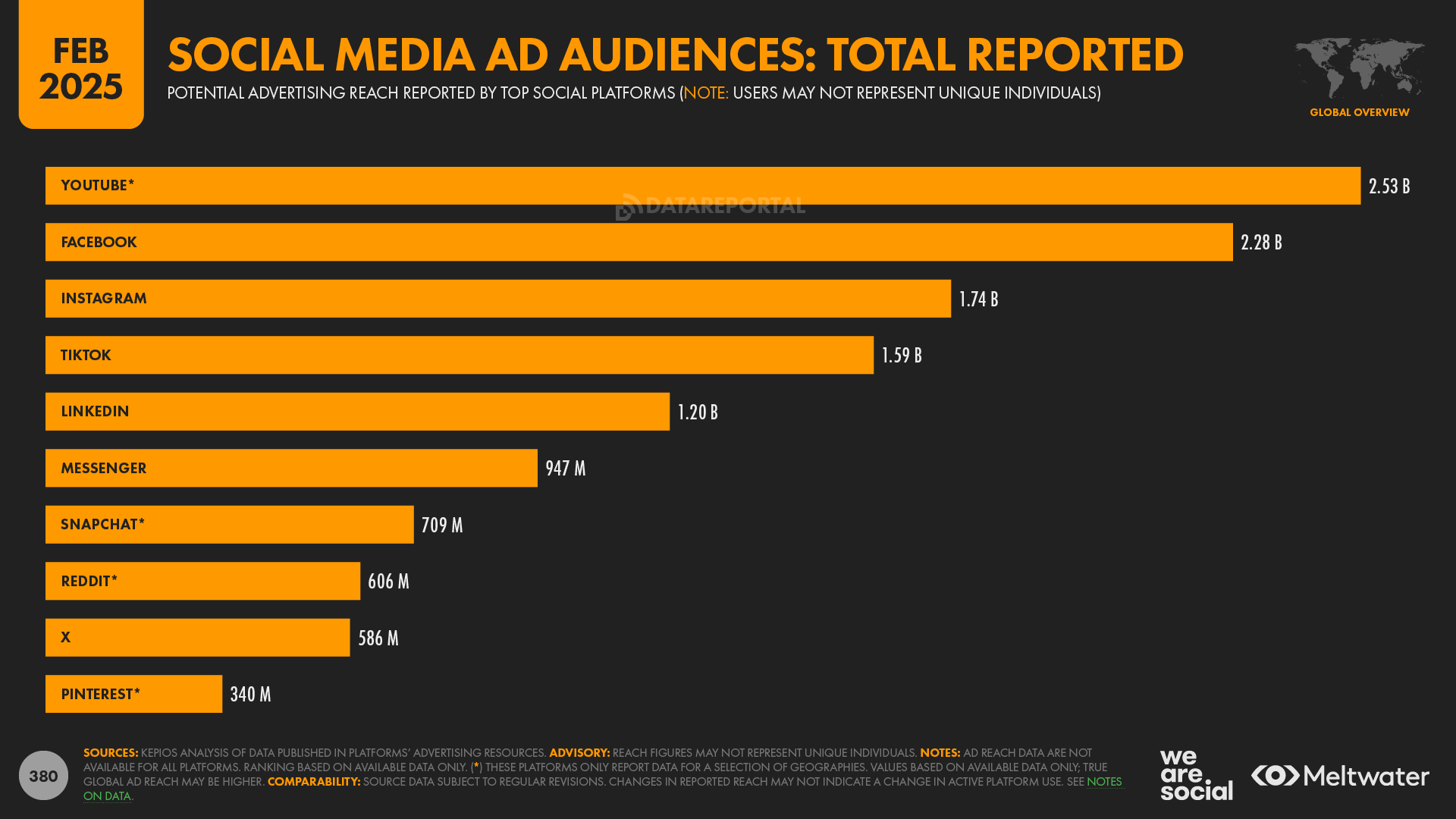

Moreover, DataReportal estimates Reddit’s maximum potential ad reach to be about 606 million users considering its userbase statistics. This sounds impressive until compared to TikTok’s 1.6B potential reach or Instagram’s 1.75B. In a cutthroat industry like advertising, one has to ask what advantages Reddit offers when competitors offer 3x the exposure. Even the slow-growing LinkedIn offers an estimated reach of 1.2B users.

Reddit is also fully aware of their flawed monetization scheme, even flashing these statistics on the front pages of their 10-K. The company segregates their userbase into two categories:

(1) Logged-in (logged) users who have signed up for an account.

(2) Non-logged users who do not have an account.

The user experience for a non-logged user is monumentally less profitably for Reddit. Considering the majority (55%, 55.6M out of 101.7M total) of their Q4 2024 users were non-logged, Reddit’s revenue streams are explicitly impaired.

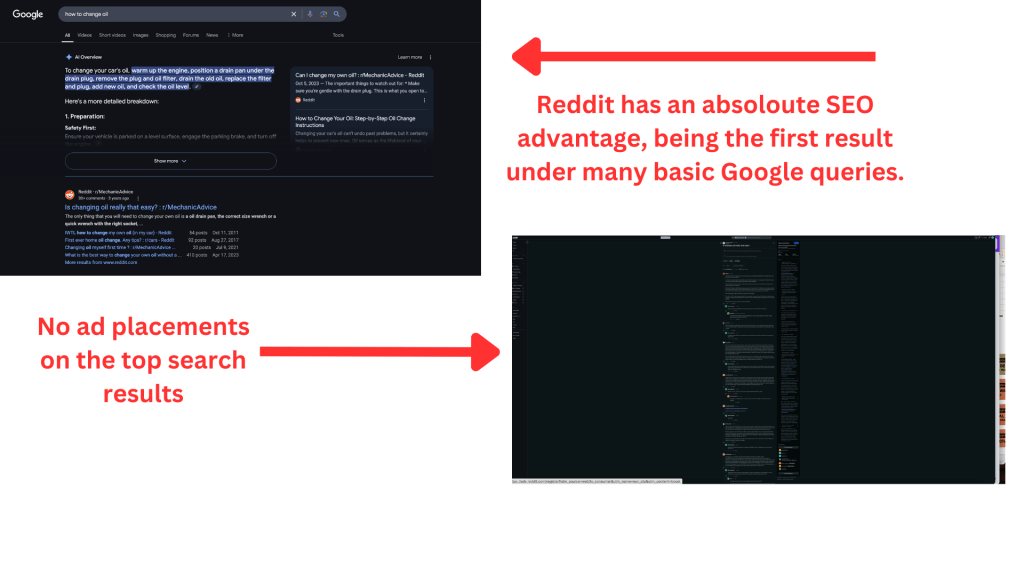

The value pipeline for a non-logged user typically starts by engaging with a Reddit post via Google Search and browsing the site for a few minutes, offering quite literally zero ad exposure in this time. An example of how Reddit fails to capture value from their immense SEO advantage is found below: despite ranking #1 in Google search results for many common queries, users see no ads when clicking through the site.

This is the standard experience for a non-logged Reddit user, and is another gap of unprofitability that Reddit just refuses to capitalize on.

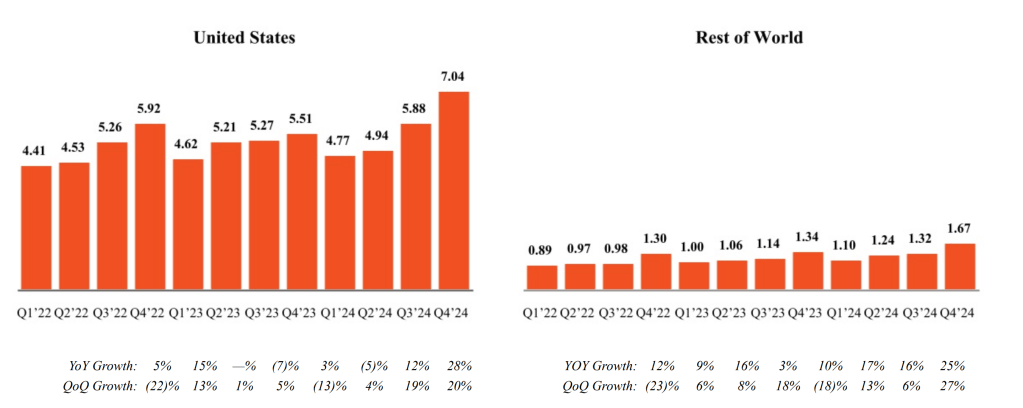

Moreover, Reddit acknowledges that the Average Revenue Per User (ARPU) of their U.S. users is considerably higher than that of their international base:

Despite this, the ARPU for the international users behind 50% of Reddit’s userbase is $1.67, meaning every international user generates $1.67 of revenue. In comparison, the other 50% of Reddit’s userbase in the United States monetizes at a $7.04 ARPU.

This means that one half of Reddit’s userbase monetizes 86% worse than the other—a problem that evaporates what could be an estimated $288M (a 22% gain) in Reddit’s total revenues if all of their users monetized at similar rates.

Lastly, while a 39% increase in YoY DAUq is impressive, Reddit slyly mentions that there are significant obstacles in monetizing this new user base. As such, they are literally watching billions of dollars burn in front of their very eyes with a poor monetization strategy. Compounding this is an already bearish outlook on DAUq growth into 2025.

“Monetization of new users is generally at a lower rate than existing users and as such, ARPU tends to grow at a lower rate than revenue in periods of strong DAUq growth. Currently, logged-out users tend to have lower engagement and spend less time on our platform compared to users who are logged in to a registered account”

Reddit 2024 Annual Filings

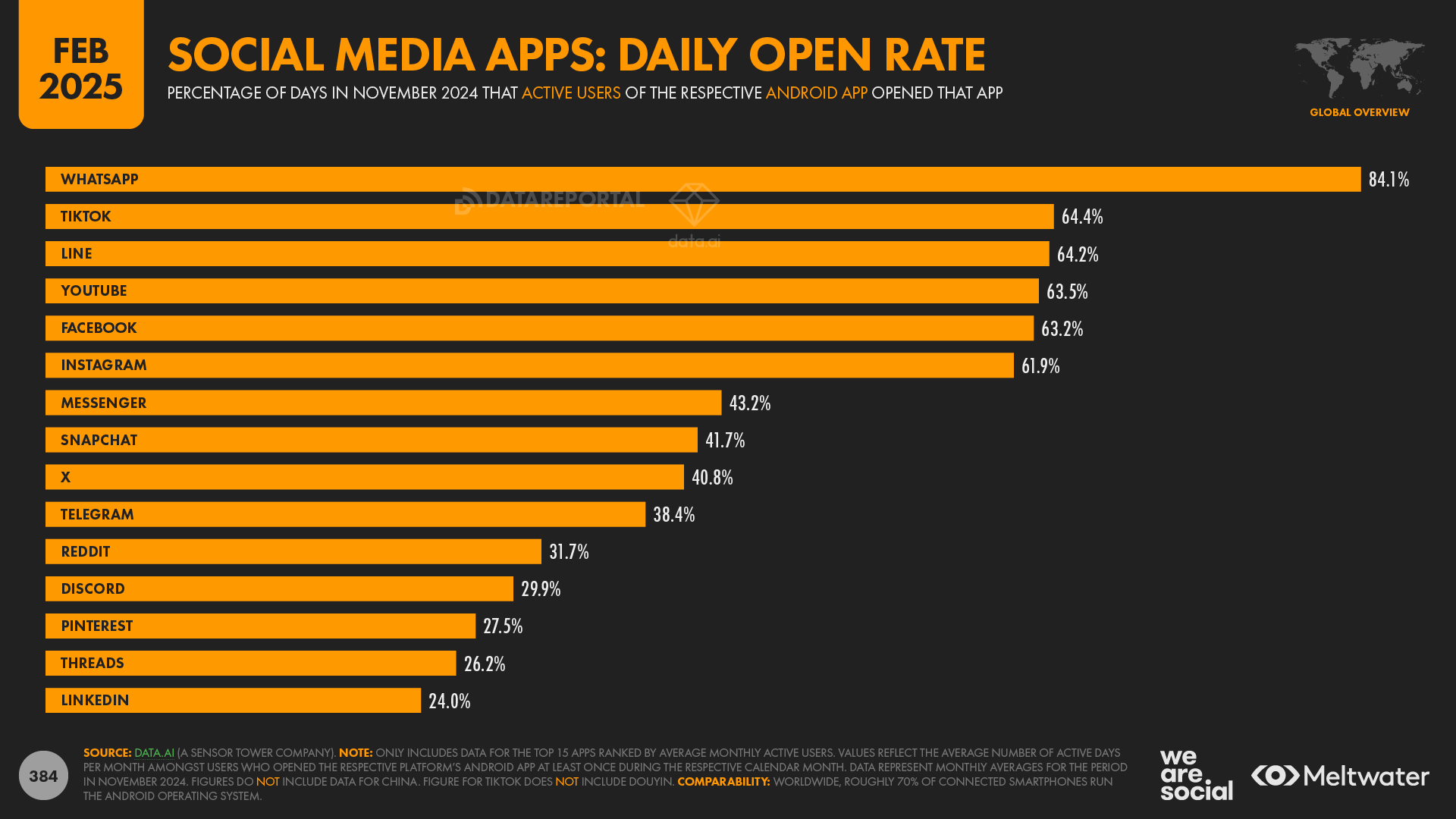

Reddit’s platform is characterized by poor user engagement stats across the board.

Statistics from DataReportal firstly report Reddit as having a 31% daily opening rate, implying that only 1 in 3 users engage with the app on a daily basis. Compared to a rival like TikTok with a 64% daily open rate, the flaws of Reddit’s platform are brought to a spotlight.

I believe this can largely be credited to Reddit’s dated content offerings. In a time where 73% of consumers surveyed by Lifewire overwhelmingly preferred to learn about a new product via short-form content, Reddit does not offer the dopamine-surging “shorts” popularized by TikTok and favoured by the modern social media user.

Simply put, surveys indicate that the days in which social media users seek genuinely informative content through blogs and lengthy videos are long over, with YouTube and Instagram both making quick pivots to integrate short-form videos to their pipeline. Reddit has thus lagged behind, naively refusing to innovate under the belief that what the internet liked in 2005 is what it likes now.

There may very well come a time where Reddit drowns in its own irrelevance thanks to its ignorance to what nearly every competitor agrees is the future of social media: short-form content.

Reddit is Lying About Its Userbase Figures

- Key user metrics could be inflated upwards of 70%+

- Google Search is knowingly exploited to overstate DAUq numbers upwards of 500%

I have absolute conviction to the fact that Reddit is knowingly inflating their user count (DAUq) for the means of pumping their stock. Since the company is unprofitable, this is the only metric we can rely on to gauge growth. Roblox, a similar social platform, suffered a similar terminal flaw, and is hence down 54% from its all-time high.

In fact, lodged within a sub-paragraph on page 55 of their 10-K, Reddit casually admits that “[m]easuring the number of logged-out visitors is difficult and complex.” What I believe this refers to is how the company knowingly exploits Google Search results to count one “DAUq” as upwards of five.

Google Search results universally prioritize results from Reddit, displaying answers to common queries in sets of five. What therefore typically happens is that one user will click on the most prominent result before cycling through the next—all leading to Reddit.

Since Reddit admits tracking these users is a difficult process, I find it very likely that they are simply abusing their SEO privileges to count one user filtering through Google Search results as five DAUq, illustrated below:

Simple logic can also support this hypothesis: Reddit is approaching its twentieth birthday, thus explosive growth figures of 39% YoY seem impossible for such a mature platform with equally dated content offerings… unless, of course, these figures are purposefully inflated to spur bullish momentum in Reddit’s stock price.

Moreover, even considering logged users, Reddit is notoriously plagued with duplicate accounts—colloquially known as “alternative accounts” or “alts.” I can confidently say that in my time on the web, I have created at least 70+ loose Reddit accounts. Many users on Reddit similarly confess to creating “alts,” as seen in surveys below regarding which users use duplicate accounts:

Fake bot accounts also notoriously run rampant on Reddit. Some users estimate that upwards of 70% of the sites users are not actually real people. Others hint at Reddit’s willful ignorance to the bot problem, acknowledging their interest to inflate their user count as a publicly traded company and thus supporting my thesis:

This is actually something they openly admit in their 10-K:

Lastly, Reddit’s own “Online Users” statistics signal a high degree of what could be either botted accounts or fake users. Take, for instance, the site’s most populated community “r/Funny,” with over 66 million members.

Despite the high member count, only an average of about 2,200 of these 66 million users are on Reddit during peak hours (Friday evening)…. that’s a brutal 0.0003% engagement rate. Similar sentiment is held across quite literally each and every subreddit.

There is therefore a clear disconnect between Reddit’s supposed hundred-million strong user base and their actual engagement statistics.

Fundamentals: Reddit is Severely Overvalued by All Basic Metrics

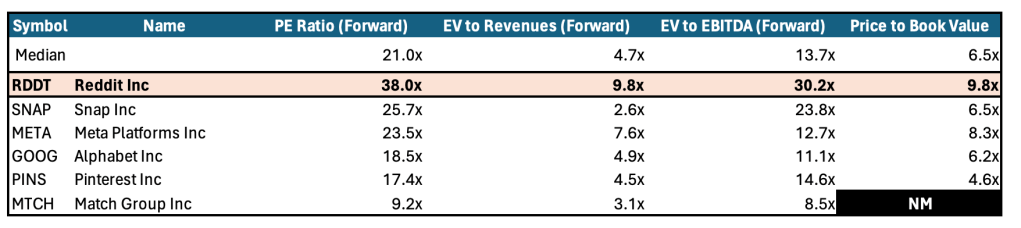

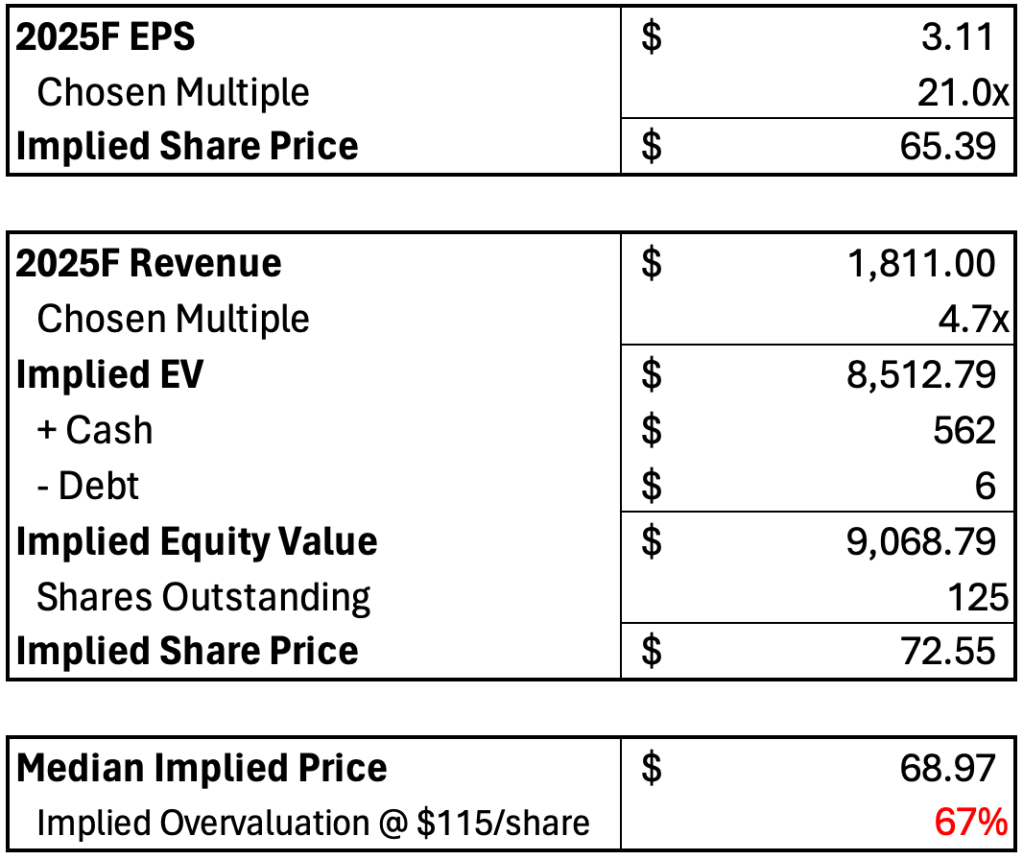

By quite literally every comparable value metric, Reddit is egregiously overvalued against its social media peers:

Hovering at $115/share, this implies Reddit currently trades at a median 60% premium to fair value—a ridiculous overvaluation:

Reddit Uses Expenses as a Mirage for Productivity

- Key expenses are confessed to be largely “stock-based compensation” for employees

- The company burned $842M of $1.3B in 2024 revenues on “stock-based compensation” to enrich executives and employees during Reddit’s lucrative IPO.

Reddit lists its primary expenses in its 10-K as the following:

(1) Research & Development (R&D)

(2) Sales & Marketing (S&M)

(3) General & Administrative (G&A)

While R&D and S&M expenses imply that Reddit is digging into its own pockets in a grand scheme to turn profitable, the company confesses on the obscured 62nd page of their 10-K that all three of these expenses are primarily “employee-related costs” (compensation).

In this time, the company actually sacrificed their own profitability for the means of handing out $842 million in generous “stock-based compensation” to employees and executives. On only $1.3B in revenues, this means Reddit consciously chose to enrich its owners by practically donating 65% of their earnings—a fundamentally stupid business move for a company in its first year on the markets.

This “stock-based compensation” would have made a lot of employees particularly rich as the stock jumped 251% by February of this year.

In this same time, Reddit’s Cost of Revenue—marking actual, productive expenses—suspiciously dropped to 10% of their annual revenues for 2024 (down from 14% in 2023), while R&D (disguised compensation) surged from 55% to 72% YoY.

- Reddit somehow magnified their annual losses 500% in the first year of being public.

Additionally, despite going public, Reddit refuses to create meaningful shareholder value and instead managed to balloon their annual losses from -$90M in 2023 to -$484M in 2024… simply astonishing.

In fact, Reddit has yet to see a single year of recorded profit:

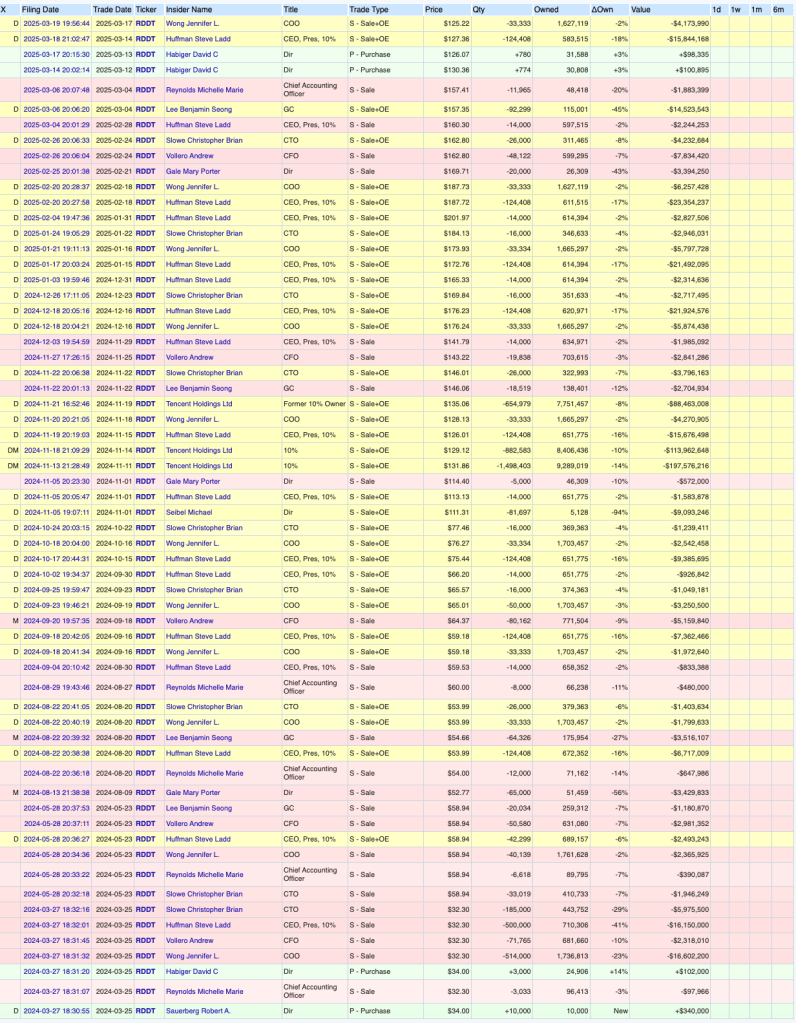

Insiders Welcomed a Massive Selloff in 2024

- CEO Steven Huffman sold approx. 20% of his stake ($153M) in Reddit in its first year public.

- Only 4 of 62 insider transactions since IPO have been purchases.

OpenInsider namely reports that executives have sold a combined $696M in stock within a year of the IPO. Conveniently, $508M (73%) of these sales happened during the stock’s +175% bull run between October and February. This likely relates to the “elevated stock-based compensation” the company mentions in their 10-K.

Moreover, while 2024’s executive compensation numbers have yet to be disclosed, it is clear that CEO Huffman views himself as the heaven-sent saviour of the stock markets, granting himself a $193,000,000 compensation package in 2023 despite his company facing a $90M loss.

For reference, Jamie Dimon was paid $36M in this same time while J.P. Morgan turned a $47.7B profit. Steve Huffman paid himself 536% more than Jamie Dimon himself, making him 2023’s second-highest paid CEO behind Texas Pacific’s Jon Winkelried.

CEO Huffman is a Petty and Immature Grifter

- Huffman has a sketchy history in the public eye, marked by several unnecessary, unprofessional and frankly inappropriate controversies.

Sleazy compensation packages are very much the least of omnipresent CEO Steve Huffman’s controversial past. After a nine-year hiatus from Reddit following its acquisition by Condé Nast in 2006, he returned to the company as CEO in 2015.

Huffman’s volatile corporate history began in 2016 after users on his own platform revealed that he actively modified comments on the site he found personally insulting. This behaviour is, again, not by a jealous high-schooler, but rather the CEO of a $20B publicly-traded company.

In 2023, in advance of the company’s IPO, Huffman tried to hedge against market share compression by blocking the use of popular third-party API on the site, sparking widespread protest by Reddit’s user base. In this time, the company’s vulnerability came to the spotlight as thousands of communities retaliated to the API ban by simply shutting down, with many never returning to the site. In a cheap attempt to recover his nosediving public image, Huffman immediately ordered for the fan-favourite “r/Place” community to return to Reddit, distracting users from the API crisis by letting them collaborate on a site-wide digital canvas. Within minutes of its launch, passionate Redditors had used the canvas to draw out “F**K SPEZ” (a reference to Huffman’s Reddit username, u/spez) in a colourful display of protest.

I will reiterate that this is coming from the man heading a $20B public company; the same man who has no practical management experience outside of Reddit.

Reddit is a Poorly-Moderated Hellscape of Extremism.

- Reddit turns a blind eye to the thousands of communities (subreddits) on their platform promoting blatantly misogynistic, racist, homophobic and otherwise harmful ideologies.

- The company briefly attempted to clean up their image pre-IPO, recklessly kicking millions of users off the site.

- The platform is actively deteriorating its own moat, and management has a profound misunderstanding of its own key user base.

While its slogan is “the front page of the internet,” Reddit is colloquially known as “the trenches of the internet” considering its user base, despite what management gaslights itself into thinking. This is a fact I believe bulls are blind to, as they are simply misinformed about Reddit’s market position and broader reputation.

Reddit is not the wholesome and informative forum they boast about in their 10-K’s—it is the unmoderated wasteland of the internet. In fact, Wikipedia has a running, 44-page long list of controversial subreddits (communities) from Reddit’s history.

From the politically turbulent “r/The_Donald” to the extremist “r/NoNewNormal” pushing COVID-19 misinformation and anti-government conspiracies, Reddit has discretely been home to the dredges of the internet for the better part of two decades. Entire side communities like “r/BanFemaleHateSubs” (which, for the record, hosts a scary 100,000+ members) have emerged in protest to rampant misogyny on the platform. Again, since all content on Reddit is entirely user-moderated, there is no systematic methods to prevent such degeneracy from plaguing the site.

This is something the company has tried—and failed—to quietly sweep under the money-lined tables of their IPO by shutting down these extremist communities. However, their “clean-up” attempts have done no more than kick millions of loyal users off the site.

The unfortunate truth is that Reddit has historically earned hundreds of millions of dollars by soliciting these depraved communities, and trying to shut them down to become “advertiser friendly” has done nothing but harm to the company.

Fellow social media forum Tumblr was crucified under a similar state in 2018, losing quite literally 99% of its valuation in a five year span as less-favourable communities were removed from the site.

Ultimately, Reddit’s management trapped themselves at the helm of a sinking ship with regards to content on the platform. After reaping twenty years of profit from its user’s degeneracy, their desperate clean-up attempts have done nothing but eat into their own margins and diminish their moat.

“Reddit monetizes white supremacy”

Former CEO Ellen Pao

Yes, folks, that is a quote by the former CEO of a publicly-traded company.

Conclusion: Some Companies Just Shouldn’t be Public

There comes a point at which a company’s business model is so terminally flawed that it really just does not deserve to be listed on public exhcanges.

Already 67% overvalued, Reddit is a delicate house of cards constructed on a two-decade legacy of falsified user statistics and sleazy executives looking for a big paycheck.

A metaphorical petri dish of degeneracy, Reddit is somehow the proud home to the darkest and worst corners of the internet, weakening its already poor advertising strategy.

While it calls itself “the front page of the internet,” I can guarantee the only front page Reddit will see in the near future is the Wall Street Journal’s “Market Losers” section.

Works Cited

[1] Company Filings

[2] Reddit Forum Posts (User Surveys)

[3] YCharts (Financial Data)

[4] Forbes (Historical Controversies)

[5] Wikipedia [Aggregate of Controversial Subreddits]

[6] OpenInsider (Insider Trading Data)

[7] DataReportal (Social Media Statistics)

[8] Investopedia (Executive Compensation Statistics)

[9] Yahoo Finance (Bull Case Pointers)

Leave a comment