I invest in good companies.

Grigshaw is a wholly equity-driven firm, credited to the belief that fundamentally solid companies backed by durable trends should be “blind” to macroeconomic conditions.

While macroeconomics obviously play a critical role in the financial markets, the high-quality businesses I buy into should withstand tough times and thrive in prosperous ones.

What Makes a Good Company?

Capital

Velocity.

The No. 1 Factor in Maintaining Growth.

Introduction to Capital Velocity.

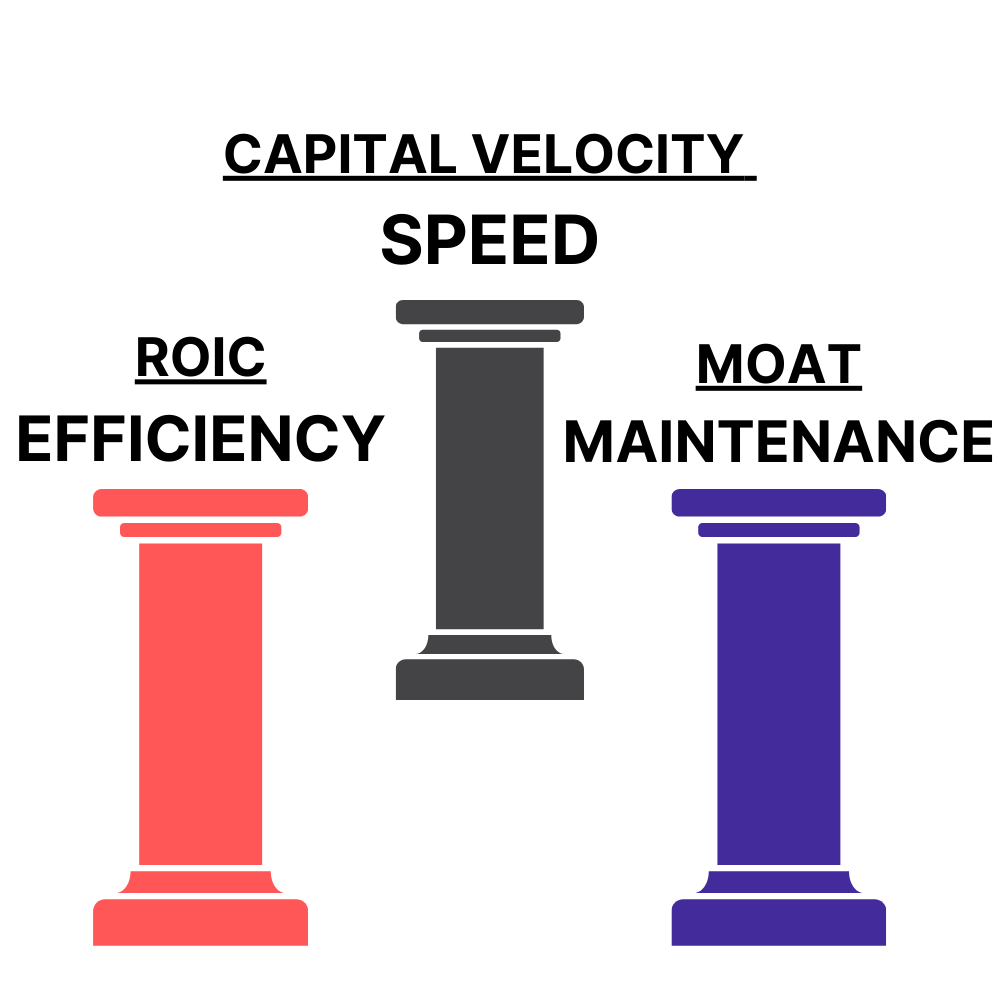

Capital Velocity measures how quickly a company converts capital into meaningful returns.

Grigshaw is founded on the idea that a high-quality company should be able to sustain monumental growth by means of high capital velocity, being wholly engrossed in generating robust returns.

“HAVING MONEY’S NOT EVERYTHING, NOT HAVING IT IS”

Companies who don’t use free cash to generate growth might as well light their cash reserves on fire.

These firms with low capital velocity will fail to show any meaningful growth or returns in the long term. High capital velocity is the single most important factor in guaranteeing exponential growth: high-quality companies should be able to quickly convert an immense amount of cash into enduring growth.

Return on Invested Capital (ROIC)

Measuring success in the modern day.

Next to capital velocity, plentiful Returns on Invested Capital another key pillar of a high-quality company. Not only should a company be able to quickly convert cash into meaningful returns, but it should do so with tremendous efficiency.

Moat.

A moat is the irreplaceable competitive advantage that distinguishing a company from competition.

Grigshaw invests in wide-moat companies who use their absolute advantage to maintain dominance in a global trend.

Examples include Philip Morris, who’s near monopoly over the nicotine pouch market has reaped them immense success.

The Grigshaw Gist

1.

Velocity is Vital.

A high-quality company should be able to quickly spin free cash into prosperous reteurns.

2.

Robust ROICs.

Any good company should be able to not only translate capital into growth quickly, but also efficiently.

3.

Moats Mean Everything.

High-quality companies leverage wide moats to sustain dominance over a profitable trend.